New Zealand's licensing process for selling real estate isn’t for the weak of heart. The Real Estate Agents Board (REAB), is the body responsible for administering this eponymous act. Those wishing to make the decisions can either do so on their own or partner with an agency of record like Barfoot & Thompson. The company is family owned and operates as one branch. They are also an educated bunch, who understand their real estate through their marketing.

There are many real estate agencies operating in Auckland. Barfoot & Thompson and Landcorp are the most prominent real estate agents in the Auckland region. Although there is a lot of competition, the quality of customer service is unmatched. They use the latest technology, and they have dedicated customer service staff. They are the company to call if you're looking for the right property, at the right cost. They offer the most competitive rates in the country, and they will match or beat any other competitor's offer in almost all cases.

FAQ

How do I calculate my rate of interest?

Interest rates change daily based on market conditions. The average interest rates for the last week were 4.39%. To calculate your interest rate, multiply the number of years you will be financing by the interest rate. For example: If you finance $200,000 over 20 year at 5% per annum, your interest rates are 0.05 x 20% 1% which equals ten base points.

How much will it cost to replace windows

Replacement windows can cost anywhere from $1,500 to $3,000. The total cost of replacing all of your windows will depend on the exact size, style, and brand of windows you choose.

How long does it take for my house to be sold?

It depends on many different factors, including the condition of your home, the number of similar homes currently listed for sale, the overall demand for homes in your area, the local housing market conditions, etc. It may take 7 days to 90 or more depending on these factors.

How much money can I get to buy my house?

This varies greatly based on several factors, such as the condition of your home and the amount of time it has been on the market. Zillow.com shows that the average home sells for $203,000 in the US. This

Can I purchase a house with no down payment?

Yes! Yes! There are many programs that make it possible for people with low incomes to buy a house. These programs include conventional mortgages, VA loans, USDA loans and government-backed loans (FHA), VA loan, USDA loans, as well as conventional loans. For more information, visit our website.

What is a reverse loan?

Reverse mortgages are a way to borrow funds from your home, without having any equity. You can draw money from your home equity, while you live in the property. There are two types to choose from: government-insured or conventional. With a conventional reverse mortgage, you must repay the amount borrowed plus an origination fee. If you choose FHA insurance, the repayment is covered by the federal government.

What should you think about when investing in real property?

You must first ensure you have enough funds to invest in property. You can borrow money from a bank or financial institution if you don't have enough money. Aside from making sure that you aren't in debt, it is also important to know that defaulting on a loan will result in you not being able to repay the amount you borrowed.

You also need to make sure that you know how much you can spend on an investment property each month. This amount should include mortgage payments, taxes, insurance and maintenance costs.

Finally, ensure the safety of your area before you buy an investment property. It would be a good idea to live somewhere else while looking for properties.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

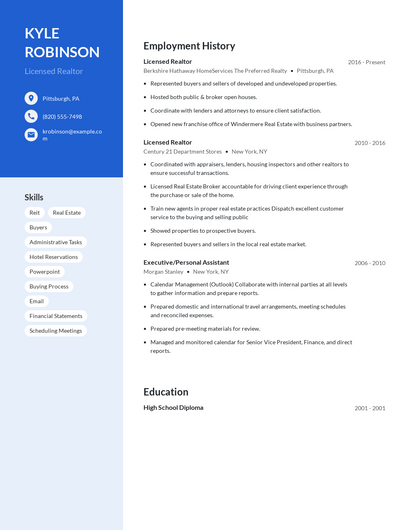

How to Locate Real Estate Agents

The real estate agent plays a crucial role in the market. They offer advice and help with legal matters, as well selling and managing properties. You will find the best real estate agents with experience, knowledge and communication skills. To find a qualified professional, you should look at online reviews and ask friends and family for recommendations. Consider hiring a local agent who is experienced in your area.

Realtors work with both buyers and sellers of residential real estate. A realtor helps clients to buy or sell their homes. A realtor helps clients find the right house. They also help with negotiations, inspections, and coordination of closing costs. Most agents charge a commission fee based upon the sale price. Some realtors do not charge fees if the transaction is closed.

There are many types of realtors offered by the National Association of REALTORS (r) (NAR). Licensed realtors must pass a test and pay fees to become members of NAR. The course must be passed and the exam must be passed by certified realtors. NAR has established standards for accredited realtors.