Real estate and stocks are both excellent investment vehicles, but each has its own set of advantages and disadvantages. Here are some key differences between the two: Liquidity, Risks, Location, and Profits. Investing in real estate may be a better option for those who are looking to generate a passive income stream over the long term. Real estate has the potential to appreciate significantly and also offers passive income. Stocks are, however, subject to market, economic and inflation risks. You don't need a large cash injection to buy stocks, but you can easily sell them.

Profits

There are many benefits to real estate investments. For starters, real estate can create cash flow. Cash flow is the money left after expenses are paid. Rental income is a great way to offset expenses and make extra money. Your cash flow will increase the longer you keep a property. There are a number of tax deductions and tax breaks available for real estate. These tax breaks include reasonable expenses related operation and ownership.

Investing in real property offers the flexibility many investors require. You can slowly build a portfolio, and then supplement your income with rental income. Fix-and-flip income can be used as your primary source of income. You have complete control over your property and can manage it according to your needs. You are also your boss. There are no time limits and no salary caps when working in this field.

There are risks

It is important to know the differences between stocks and real estate investing. Real estate investment is much safer than stocks. Real estate has a lower risk of capital loss because the land you own is collateral for your initial investment. On the other hand, stocks are more liquid, so you can cash out at any time. In addition, stocks can generate income through dividends. Investors should be aware that stock prices can fluctuate and could cause investors to make emotional decisions.

This is because you have to wait until your return before you can see any positive effects. Stocks are able to return 10% annually, but real estate can return three to four percent. You will still see a 20% annual return if you have at least 20% equity in the property. This is far more than what you would get from stocks. Moreover, it can be difficult to find properties with good values and then sell them for less than what you paid for them. Additionally, if you are unable to sell your property in the required timeframe, you could be subject to a tax penalty, which is often higher than the market's average return.

Liquidity

Liquidity means the ease of an investor's ability to convert their investment into money. Stocks have more liquidity than real estate investments because they are available to be sold during regular market hours. While it may take a few days to sell an entire position in stocks, investors can get their money when they want. Real estate investments, however, are not liquid and may take years to appreciate.

Real estate investing also has the advantage of generating income rather than capital gains. This makes it much easier to automate. Inflation also affects the income component. This means that investors can spend their real estate profits sooner. Another benefit to real estate investing is its lower volatility. This means that withdrawals are more stable and less likely be affected by short term volatility. It doesn't matter what your personal preferences are, you will find a strategy that works for you.

Localization

Direct investing in real estate is not for everyone. Real estate can be a great addition to your portfolio if you're looking for a balanced portfolio. It is simple to invest in the stock market and manage it. In addition, investing in real estate is much less risky than investing in stock index funds. These tips will help you make informed decisions if you're thinking of investing in real property.

FAQ

How can I calculate my interest rate

Market conditions can affect how interest rates change each day. The average interest rate during the last week was 4.39%. Add the number of years that you plan to finance to get your interest rates. For example: If you finance $200,000 over 20 year at 5% per annum, your interest rates are 0.05 x 20% 1% which equals ten base points.

What is the maximum number of times I can refinance my mortgage?

It all depends on whether your mortgage broker or another lender is involved in the refinance. Refinances are usually allowed once every five years in both cases.

What is the average time it takes to get a mortgage approval?

It depends on several factors such as credit score, income level, type of loan, etc. Generally speaking, it takes around 30 days to get a mortgage approved.

What are the three most important factors when buying a house?

When buying any type or home, the three most important factors are price, location, and size. Location refers the area you desire to live. Price refers to what you're willing to pay for the property. Size refers how much space you require.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

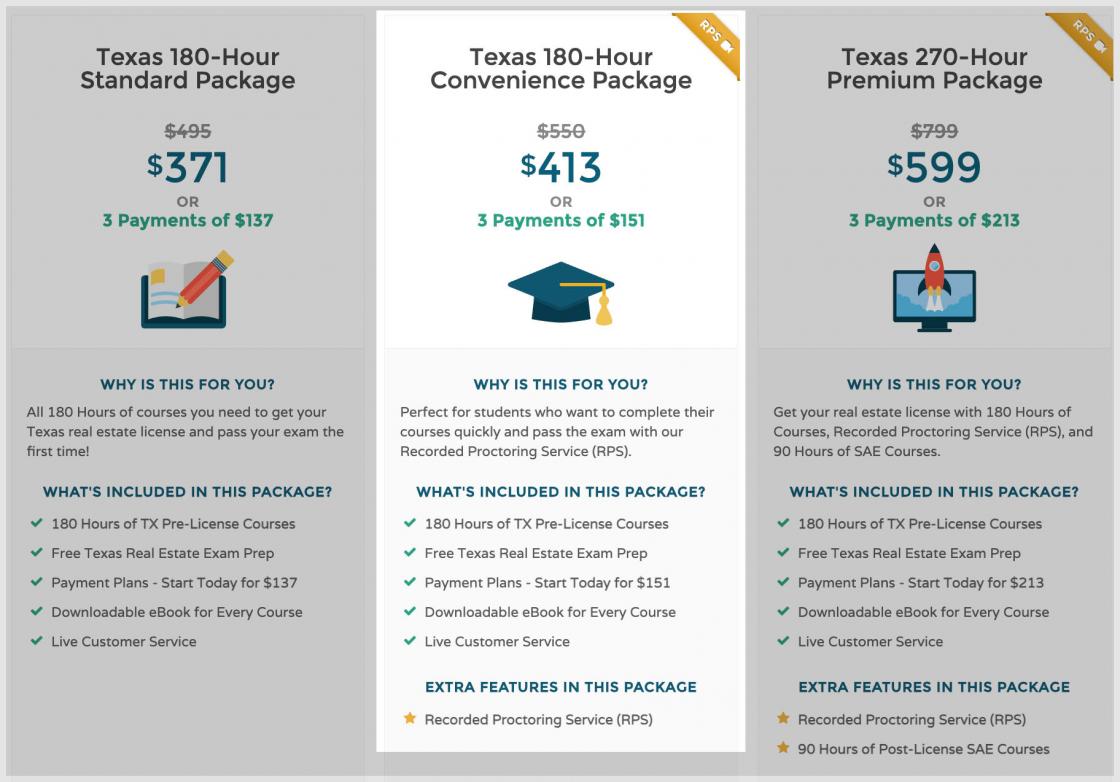

How to Find Real Estate Agents

A vital part of the real estate industry is played by real estate agents. They can sell properties and homes as well as provide property management and legal advice. Experience in the field, knowledge of the area, and communication skills will make a great real estate agent. You can look online for reviews and ask your friends and family to recommend qualified professionals. Consider hiring a local agent who is experienced in your area.

Realtors work with residential property sellers and buyers. A realtor helps clients to buy or sell their homes. Realtors assist clients in finding the perfect house. A commission fee is usually charged by realtors based on the selling price of the property. Unless the transaction is completed, however some realtors may not charge any fees.

The National Association of Realtors(r), (NAR), has several types of licensed realtors. NAR requires licensed realtors to pass a test. Certified realtors are required to complete a course and pass an exam. Accredited realtors are professionals who meet certain standards set by NAR.